Recalculation of the Solvency II transitional measures on technical provisions J. Cooke*, A. Scott, D. Smith, A. Rogan, R. Coope

A PRICING TECHNIQUE TO CALCULATE THE SOLVENCY CAPITAL REQUIREMENT FOR NON-LIFE PREMIUM RISK TRONCONI ANDREA Torino, 4 Dicembre ppt download

Date (Arial 16pt) Title of the event – (Arial 28pt bold) Subtitle for event – (Arial 28pt) Standard formula appropriateness for life and general insurers. - ppt download

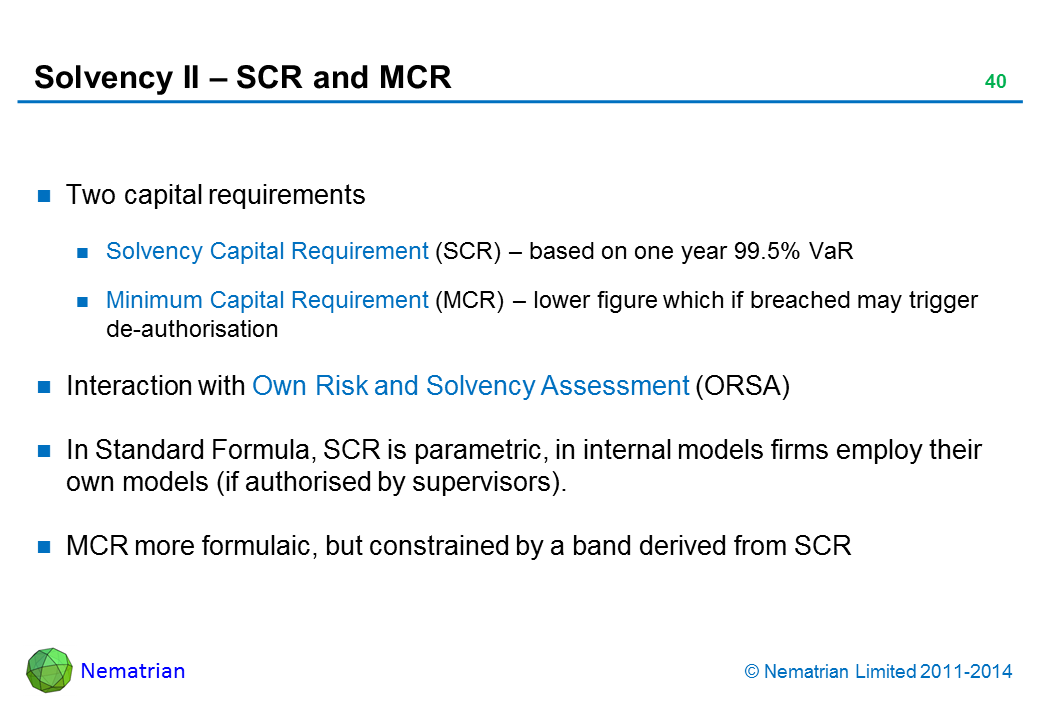

Solvency capital requirement and the claims development result D. Munroe*, B. Zehnwirth and I. Goldenberg

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

:max_bytes(150000):strip_icc()/solvencyratio-d2458ed42e764bf8b69b6bff480130b1.jpg)